In the world of insurance, traditional processes have often been marked by long waits, paperwork, and uncertainty. For customers, it can feel like navigating a maze of forms and approvals. However, the rise of AI in insurance is changing that dynamic for the better. By transforming risk assessment and claims processing, AI is streamlining these systems, making them faster, more accurate, and transparent.

This technology promises efficiency and ensures that insurers and customers are treated fairly. As AI continues to evolve, it's clear that the future of insurance will be smarter, more responsive, and more customer-centric.

Risk assessment has always been the heart of insurance. It helps companies decide who to insure, what premium to charge, and how much risk is involved. In the past, this process depended heavily on manual data checks, outdated records, and a lot of guesswork. Today, AI in insurance is changing all of that by using data-driven insights.

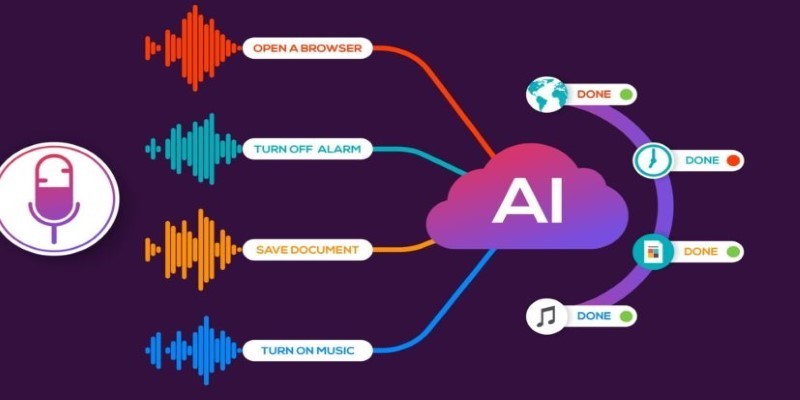

AI systems can analyze massive amounts of data from various sources, including social media, financial records, driving history, and weather patterns. This allows insurance companies to create highly accurate risk profiles for individuals and businesses. AI models can even predict potential risks by identifying patterns and behaviors that might otherwise go unnoticed.

For example, in auto insurance, AI can collect data from vehicle sensors to analyze driving habits like speed, braking, and location. A careful driver with good habits might get lower premiums because the risk is reduced. This personalized approach is not only more accurate but also fairer to customers.

Additionally, in health insurance, AI can evaluate an individual's medical history, lifestyle, and genetic information to forecast future health threats. This enables companies to design customized health plans that are more suited to their customers' requirements while eliminating unnecessary expenses.

Overall, AI in insurance is making risk evaluation smarter and more customized, which is good for both companies and customers because it offers proper coverage and reasonable pricing.

Claim processing is one of the most frustrating parts of dealing with insurance. Customers often complain about long waiting times, repeated document submissions, and unclear responses. AI in insurance is solving real problems, especially in risk assessment and claims processing.

AI tools can now handle claims from start to finish with minimal human intervention. When a customer submits a claim, AI systems can instantly verify policy details, check for fraud, and assess the damage. For example, if a car accident occurs, the customer can upload pictures of the damage through a mobile app. AI algorithms analyze these images, estimate the repair costs, and approve the claim within minutes.

In-home insurance, AI-driven drones, and image recognition tools can assess property damage after natural disasters like floods or storms. This eliminates the need for long inspections and allows claims to be processed faster.

One of the biggest challenges in claims processing is fraud detection. Insurance fraud costs companies billions of dollars every year. AI systems are trained to detect suspicious patterns, unusual claims history, and inconsistencies in data. This helps insurers prevent fraud and maintain trust with honest customers.

More importantly, AI makes claims processing transparent. Customers get real-time updates on the status of their claims, estimated timelines, and clear communication. This level of service was hard to achieve with traditional methods.

AI in insurance is revolutionizing risk assessment and claims processing by making them faster, more accurate, and more customer-friendly. This enhances the overall experience for both insurers and policyholders through greater efficiency and personalized service.

While AI offers significant benefits in insurance, some challenges must be addressed. One of the primary concerns is data privacy. AI systems rely on large amounts of personal data to operate effectively, raising important questions about how customer data is collected, stored, and used. Insurance companies must ensure compliance with strict data protection regulations and respect customer privacy. Transparency in data usage is crucial for building and maintaining trust with policyholders.

Another challenge is the potential for bias in AI models. If the data used to train AI systems is incomplete or biased, it can lead to unfair risk assessments and claims decisions. For example, biased data may result in certain demographics being charged higher premiums or receiving slower claims approvals. To avoid this, insurers must regularly review and update their AI models to ensure they are fair and unbiased.

Despite these hurdles, the opportunities for AI in insurance are vast. AI-powered chatbots provide round-the-clock customer support, answering common questions and guiding users through the claims process. Predictive analytics allow insurers to develop new products tailored to emerging customer needs while also improving underwriting efficiency. AI tools help underwriters analyze large datasets quickly, enabling faster, more informed decision-making. This leads to quicker policy approvals and better risk management.

Additionally, machine learning and automation can lower operational costs, streamline workflows, and keep insurers competitive in a fast-evolving market. As AI continues to advance, companies that embrace this technology will be better positioned to meet customer demands, handle risks, and offer improved service across all aspects of insurance.

AI in insurance is revolutionizing how risk assessment and claims processing are handled. By utilizing advanced data analytics and machine learning, AI helps insurers evaluate risks more accurately and process claims faster. Customers benefit from personalized policies, quicker claim approvals, and enhanced transparency. While challenges such as data privacy and model bias exist, the advantages of AI in streamlining operations and improving customer experiences are undeniable. As AI continues to evolve, it will further transform the insurance industry, making it more efficient, customer-friendly, and responsive to changing needs, ultimately creating a smarter, more reliable system.

The Black Box Problem in AI highlights the difficulty of understanding AI decisions. Learn why transparency matters, how it affects trust, and what methods are used to make AI systems more explainable

Know how to produce synthetic data for deep learning, conserve resources, and improve model accuracy by applying many methods

AI can't replace teachers but transforms e-learning through personalized learning, smart content creation, and data analysis

Master MLOps to streamline your AI projects. This guide explains how MLOps helps in managing AI lifecycle effectively, from model development to deployment and monitoring

How AI-powered HR and recruitment tools are transforming hiring processes with faster screening, smarter candidate selection, and improved employee retention strategies for modern businesses

Speech recognition uses artificial intelligence to convert spoken words into digital meaning. This guide explains how speech recognition works and how AI interprets human speech with accuracy

Explore three major mining challenges and six smart solutions to reduce costs, ensure safety, and boost sustainable operations

Create profoundly relevant, highly engaging material using AI and psychographics that drives outcomes and increases participation

Can artificial intelligence make us safer? Discover how AI improves security, detects threats, and supports emergency response

Nvidia Acquires Israeli AI Startup for $700M to expand its AI capabil-ities and integrate advanced optimization software into its platforms. Learn how this move impacts Nvidia’s strategy and the Israeli tech ecosystem

Know the pros and cons of using JavaScript for machine learning, including key tools, benefits, and when it can work best

AI in wearable technology is changing the way people track their health. Learn how smart devices use AI for real-time health monitoring, chronic care, and better wellness